D. Profitability Ratios

1. Gross Profit Margin

Gross profit margin measures the percentage of gross profit (sales revenue – cost of goods sold) against sales revenue.

Gross profit margin formula is:

From the Income Statement “danieel.id Company”, we can calculate, the company’s gross profit margin in 2019 = $ 1,780 / $ 6,115 = 29.1 %

2. Operating Profit Margin

Operating profit margin is the percentage of operating profit (gross profit – operating expense) against sales revenue

Operating profit margin formula is:

From the Income Statement “danieel.id Company”, the company’s operating profit margin in 2019 was $935 / $6,115 = 15.3%.

3. Net Profit Margin

Net Profit Margin is the percentage of earning available for common stakeholders (net profit after taxes after being reduced preferred stock dividend) to sales revenue

The net profit margin formula is:

In the case ‘danieel.id company’, from the Income Statement of this company we can calculate its Net Profit margin in 2019 = $ 530 / $6,115 = 8.7 %

The ideal value range for net profit margin differs depending on the type of industry.

For retail stores such as a net profit margin of 1-2% is common, but for jewellery stores, a margin of 10% is still considered too low.

It is also related to its Inventory Turnover, businesses with small net profit margins usually have high inventory turnover and vice versa.

4. Earnings per share (EPS)

Earnings per share is a figure that shows the amount of profit earned for each share of the Company (common stock).

Earnings per share formula is as follows:

From the Income Statement “danieel.id”, we can calculate the earnings per share of this company in 2019 is : $ 530,000 / 300,000 = $ 1.77

Note, Earnings Per Share does not automatically show the actual value obtained by shareholders, because not necessarily all of the Company’s profits in that year are distributed to shareholders (in the form of dividends).

The actual value obtained by shareholders is called dividend per share (DPS), in the case “danieel.id Company” we can see in the Financial Statements the value for 2019 is $ 0.52.

While the comparison between DPS and EPS is called dividend pay out ratio, for “danieel.id Company” in 2019 is $0.52 / $1.77 = 29.4%.

How much dividend value is distributed each year is decided in the General Meeting of Shareholders, there is no definite benchmark value, what is the ideal range of value for this.

However, this value is closely related to the future growth potential of the company.

A low dividend pay-out indicates that the company allocates most of its profits to invest again, and this means the opportunity to grow (growth) is greater, compared to the Company that decides to share all or most of its profits in the form of dividends.

5. Return On Total Assets

Return on Total Assets (ROA), sometimes also called Retun on Investment (ROI) is a measure that describes the level of effectiveness of a company in using a company’s asset assets to generate profit.

The Return on Total Assets formula is as follows:

From the Income Statement and Balance Sheet “danieel.id Company”, we can calculate the company’s ROA in 2019 = $ 530 / $11,025 = 4.8 %

This figure shows that the Company makes a profit of 4.1 cents for every 1 dollar of its assets.

6. Return On Common Equity (ROE)

Return on Common Equity (ROE) is a measure that describes the level of effectiveness of the Company to generate profits from its own capital (common equity).

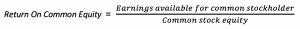

The Return on Equity formula is as follows:

From the Income Statement and Balance Sheet “danieel.id Company”, we can calculate the ROE of this company in 2019 = $ 530 / $6,970 * = 7.6 %

* Remember for common equity the total value of shareholder’s equity on the balance sheet needs to be reduced first with preferred stock.

This figure shows that the Company makes a profit of 7.6 cents for every $1 of its common equity.

Summary Profitability Ratios

From the table above, we can conclude the profitability ratio for the case “danieel.id Company) as follows:

Gross Profit margin decreased slightly (from 31% in 2018, to 29.1% in 2019), if we look at the Income Statement this is because the Cost of goods sold rose by 15% (higher than the increase in sales revenue which was only 12%).

The company’s 2019 gross profit margin was also slightly lower than the same industry average in the same year.

Operating Profit Margin “danieel.id Company” decreased compared to the previous year (from 16.3% in 2018, to 15.3% in 2019), but this figure is better than the average of similar industries in 2019 (11%)

The Company’s Net Profit Margin also fell slightly compared to the previous year (from 9.2% in 2108, to 8.7% in 2019), but this figure is better than the same-sex industry average in the same year (6.2%).

Overall of the three profitability ratios above, we can see that although nominally, the company’s profit increased compared to the previous year, but if viewed in terms of profit ratio decreased.

This shows that actually the Company continues to grow positively, it’s just that its profit margin is corrected, usually this is due to the tight competition, especially from the table above we can see that the Company’s profit margin is relatively higher than its competitors.

For Retun On Assets (ROA), the ‘danieel.id Company’ in 2018 recorded 4.8%, down from 2018 (5.3%), although it remained better than the average of similar industries which was only at the level of 4.6%.

For ROA, as we discussed earlier in the Total Asset Turnover section, the Company needs to increase the effectiveness of using its asset assets to generate profits, among others by optimizing the production capacity of existing assets, investing in new assets that are feasible, and if necessary divesting against unproductive asset assets.

Return on Equity (ROE), in 2019 of 7.6%, also fell compared to the previous year (8.3%), and this figure is also lower than the average of similar industries (8.5%).

For this ROE, “danieel.id Company” still has a chance to increase,

As we have discussed in the debt ratios section before, the company needs to (carefully of course) optimize its financial leverage in order to increase investments that will ultimately increase the profit ratio for each dollar of its own capital (owner equity).

To better understand the Profitability Ratio of ROA and ROE, please also read the following article:

Next let’s discuss Market Ratios on page 5

This post is also available in:

Indonesian